Werner’s blog: Will B.C. need to transition fuel taxes to Vehicle Kilometers Traveled (VKT) taxes?

Most would agree that the eventual adoption of electric vehicles is essential for the future of our planet, but taxes on the fuel that powers today’s vehicles funds key transit infrastructure in our province. So where will that funding come from when we stop buying fuel? UBC Sauder Associate Professor Werner Antweiler discusses in this excerpt from his latest blog post.

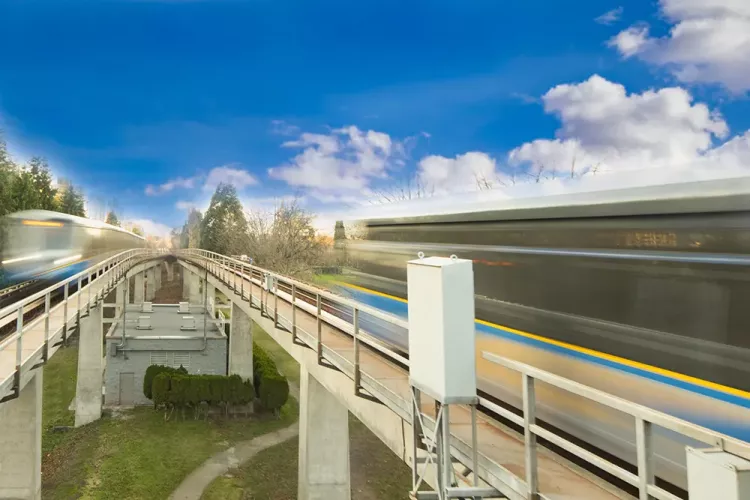

One of the consequences of transitioning from internal combustion engine vehicles (ICEVs) to battery electric vehicles (BEVs) or plug-in hybrid electric vehicles (PHEVs) is the drop in gas tax revenue, which includes the components that support Translink (within the South Coast British Columbia service region, SCTA) and BC Transit (in the Victoria area). Fuel taxes on gasoline in British Columbia are composed of a 6.75 cents/litre (¢/L) tax that supports the B.C. Transportation Financing Authority; an 18.5 ¢/L charge for Translink or a 5.5 ¢/L charge for BC Transit; and 7.75 ¢/L general revenue across the province except for the Vancouver area, where it is only 1.75 ¢/L. Put another way, provincial motor fuel taxes sum up to 27 ¢/L in Vancouver, 20 ¢/L in Victoria, and 14.5 ¢/L in the rest of the province.

Overall gasoline sales in British Columbia do not appear on a major downward trend yet, and thus it is not clear if electrification of mobility has a major impact yet. In the last pre-pandemic year 2019, 4.822 billion litres of gasoline were sold in B.C., according to Statistics Canada [23-10-0066-01]. In 2022 that number had dropped to 4.717 billion litres; a 2.2 per cent drop over 2019. Data for 2023 is not yet available. Population increased from 5.111 million in 2019 to 5.356 million in 2022, so on a per-capita basis fuel consumption dropped from 943 litres per person per year to 881 litres, a 6.6 per cent drop. If this trend persists, and electrification accelerates, we should see larger changes in the next few years. This could spell problems for revenue streams.

Revenue projections in Translink's 2023 budget are based on 1.758 billion litres of fuel consumption in the region (about 37 per cent of the provincial total), which are expected to generate about $325 million in revenue from gasoline and about $400 million in total (including diesel). If fuel consumption starts to shrink due to electrification, a significant part of this revenue is in jeopardy. B.C. needs to look at alternative forms of taxation to make up the shortfall. There is good reason to keep collecting revenue from motor vehicles due to the various negative externalities that are associated with them.

Economists have been investigating two major alternative revenue sources to complement and eventually replace dwindling motor fuel taxes. The first is a Vehicle Kilometers Traveled (VKT) tax, which in the U.S. is known as a VMT tax. The second is congestion charges that are specific by time and location. Congestion charges have not advanced in B.C. although they were discussed extensively in a report to the Metro Vancouver mayors. VMT taxes are already springing up in parts of the United States as experiments or programs (see Garret Shrode's survey from August 2023).

The key argument in favour of a VKT tax is that it is usage based: the more you drive the more you pay. The average motorist in B.C. purchases about 1,080 litres of gasoline per year, give or take. Translink's 18.5 ¢/L charge amounts to roughly $200 per year in revenue that would need to be replaced if gasoline use completely disappeared. More realistically, let's assume that we need to replace only 25 per cent of gasoline revenue with a VKT by 2030, which would be equivalent to a $50/year on the average motorist in the Metro region. If the average motorist drives about 12,000 kilometers per year, the fee should be 0.42 ¢/km (equivalent to about 14 ¢/day).

This blog is titled "Will B.C. need to transition from fuel taxes to VKT taxes?" but arguably, the question is not "if" but "when" a VKT tax will be needed. If the transition to electric vehicles speeds up and revenue streams dwindle, then a VKT tax needs to be phased in gradually to make up for the fuel tax shortfall. However, B.C. should not lower fuel tax rates along the way. Today's fuel tax rates help propel the EV transition. As a VKT tax ramps up gradually, it falls on all drivers regardless of propulsion system. Thus introducing a VKT tax will not diminish the cost gap between ICEVs and BEVs. Instead, drivers of BEVs and PHEVs will continue to enjoy a significant cost advantage.

Some economists have argued that a VKT tax should only be applied on drivers of electric vehicles rather than drivers of ICEVs. The argument hinges in part on the observation that today electric vehicles are more likely found in affluent households, and thus the existing motor fuel tax is exaggerating the general income-regressivity of that tax. My colleagues Davis and Sallee (2020) reported on this phenomenon, based on U.S. data. They found something rather interesting: while some U.S. states have adopted VMT taxes for electric vehicles (US1.7 ¢/mile, about C1.4 ¢/km) in lieu of their local gasoline tax, Davis and Sallee find that "it is not even clear based on our analysis whether the optimal mileage tax for electric vehicles is positive or negative." They also argue: "As long as gasoline is priced well below social marginal cost, it is probably not efficient to tax electric vehicle mileage because this leads to substitution toward gasoline vehicles." Thus, instituting a VKT tax should not be a replacement for fuel taxes, but rather a necessary augmentation.

Join our monthly newsletter and stay up-to-date on our innovative academic programs, world-leading faculty and research, and student and alumni achievements.